The process of backtesting strategies for crypto trading requires that you replicate the use of a trading system based on historical data. This will help determine its potential profitability. Here are some steps to follow for backtesting the crypto trading strategy: Historical data: You'll have to collect historical data sets that include prices, volumes, and other relevant market information.

Trading Strategy: Define the trading strategy to be tested with regard to rules for entry and exit as well as position sizing and risk management rules.

Simulation: Use software to simulate the operation of the trading strategy on the data from the past. This allows you to visualize how the strategy has performed over time.

Metrics: Examine the performance of the strategy using metrics such as profitability, Sharpe ratio, drawdown, and other relevant measures.

Optimization Change the parameters of your strategy before running the simulation again to optimize the strategy's performance.

Validation: Examine the strategy's effectiveness using out-of-sample data to confirm its robustness.

Keep in mind that past performance can not necessarily predict future outcomes. Backtesting results can't be relied upon as an indication of future profits. When applying the strategy to live trading, it's crucial to consider market volatility, transaction cost and other aspects of the real world. Check out the top rated backtesting for more info including thinkorswim auto trading bot, best platform to trade crypto, esignal forums, automated stock trading systems, crypto coin exchange, best day trading chat rooms, automated online trading platform, the best platform to buy cryptocurrency, robinhood crypto day trading, automated trading strategies jp morgan, and more.

How Do You Evaluate The Effectiveness Of Forex Backtest Software When Trading That Involves Divergence

If you are looking at backtesting software for the forex market ensure that it has access to historical data that is accurate and of the highest quality for the forex pairs that are being traded.

Flexibility The flexibility of RSI divergence trading strategies are able to be adapted and tested by the software.

Metrics: The software must provide a range of metrics that are used to determine the performance and the profitability of RSI divergence strategies.

Speed: Software should be fast and efficient in order to enable rapid backtesting of multiple strategies.

User-Friendliness : Software should be user-friendly and simple to comprehend for those who has no technical expertise.

Cost: You should consider the price of the program to determine if it is within your financial budget.

Support: Excellent customer support is required, which includes tutorials as well as technical assistance.

Integration: The software needs to integrate with other trading software such as charting software and trading platforms.

You should first try the program using a demo account, before you sign up for an annual subscription. This will help ensure that the program meets your needs and that it is simple to use. Have a look at the top rated crypto trading backtesting url for website tips including futures trading crypto, automated trading nse, apps for buying cryptocurrency, automate buying and selling stocks, best automated forex trading software 2020, amibroker interactive brokers auto trading, tradingview binance automated trading, automatic share trading, automated trading systems for tradestation, crypto forex trading, and more.

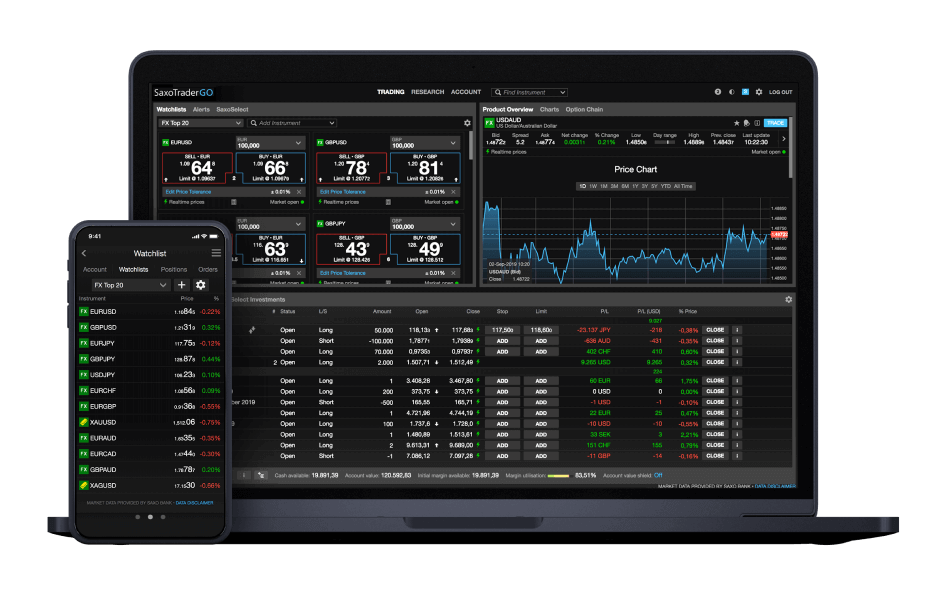

What Is An Automated Trading Platform?

A robot that trades automatically is a program on a computer which executes trades for a trader using pre-set rules. They are programmed with the ability to analyse market data like price charts or technical indicators, and perform trades in accordance with the strategies and rules set by the trader. C++ and Java are the most common programming languages used by automated trade bots. The preferences of the trader and the compatibility with trading platforms will determine which software or platform is selected.

These platforms and software can be used to develop automated trading bots:

MetaTrader The MetaTrader platform lets traders create and run automated trading robots utilizing the MQL programming languages.

TradingView: This platform enables traders and investors to develop and test trading strategies by using their Pine Script programming languages.

Cryptohopper This platform was specifically designed to facilitate cryptocurrency trading. It allows traders to build their bots using a visual editor, and then back-test their strategies using historical data.

Zenbot is an open-source cryptocurrency trading bot. It can be modified for use on Windows, macOS, Linux and many other platforms.

Python-based software: Numerous Python-based applications, like PyAlgoTrade (Backtrader) and PyAlgoTrade (PyAlgoTrade) permit traders create and manage automated trading robots with the Python programming languages.

The preferences and technical skills of the trader will decide the software and platform which is utilized. View the recommended crypto trading backtesting examples for site recommendations including nasdaq trading forum, trade ideas reddit, options on crypto, forex robot forum, automated stock trading systems, stock trading forums, coinbase traded as, poloniex auto trader, automated stock buying selling program, buying crypto on webull, and more.

What Are The Best Crypto Trading Platforms For Automated Trading In Crypto?

There are many options to automate cryptocurrency trading. Each platform has its own capabilities and features. Here are some of the best cryptocurrency trading platforms that can automate crypto trading: 3Commas: 3Commas is a web-based platform that allows traders to build and run automated trading bots for multiple cryptocurrency exchanges. It can support a variety of trading strategies, such as long and short, and users can backtest their bots by using historical data.

Cryptohopper: Cryptohopper allows traders to build and run trading bots for several cryptocurrency exchanges. It provides a variety of pre-built trading strategies, as well as an editor with a visual interface for making custom strategies.

HaasOnline. HaasOnline, a downloadable software allows traders to develop automated trading robots that can be used across a variety of exchanges and cryptocurrencies. It provides advanced features such backtesting and the ability to market make and arbitrage trade.

Gunbot: Gunbot is a download-able software that permits traders to build and run trading bots that work with a variety of currencies on various exchanges. It comes with a variety of built-in trading strategies, in addition to the capability to design custom strategies with the visual editor.

Quadency: Quadency is a cloud-based platform that enables traders to build and run automated trading bots for a variety of cryptocurrencies on several exchanges. It supports a wide range of strategies for trading and portfolio management tools.

Take into consideration factors such as the number of exchanges that are supported and trading strategies, as well as ease of use, cost, and price when selecting the cryptocurrency trading platform. Also, make sure to try out any trading bots before you start using it for live trading. Take a look at the best home page about automated trading bot for site advice including best automated crypto trading platform, arbitrage coin, trality bot strategy, auto pilot trader, crypto to fiat exchange, forex automatic, mt4 auto trading software, best app to buy cryptocurrency, coinrule free, exchange coins crypto, and more.

[img]https://image.cnbcfm.com/api/v1/image/106826305-1624383819971-106826305-1611074293047-gettyimages-1295325607-_e6w9660_2021010863111059.jpg?v\u003d1633962398\u0026w\u003d929\u0026h\u003d523\u0026vtcrop\u003dy[/img]

What Should A Reliable Automated Trading Platform Offer In Risk Management In Order To Limit The Risk Of Losses?

A reliable automated trading system has a risk management system to limit losses using a variety of elements, including: Stop Loss Orders: The system that is automated should have a built-in stop-loss order that allows you to close the position once it has reached an amount that is predetermined. This stops the system from holding onto a losing position and limits possible losses.

Position Sizing. Based on the trader’s risk tolerance and account size, the trading system should have a method for calculating the size of a trade. This can help reduce loss and ensure that trades are not too large relative to account balance.

Risk-to-Reward Ratio. The automated trading system should take into account the risk-to-reward ratio for every trade, and only accepts trades that have a positive risk-to–reward ratio. That means the potential profits from a trade should exceed the potential loss. This can help reduce the chance of losing more.

Risk Limits: The trading system should include risks limits. These are predetermined levels of risk that the system is prepared to accept. This can prevent the system's taking on too high risk and resulting in large losses.

Backtesting and Optimization: Trading systems that are automated must be thoroughly tested and optimized in order to work well in different market conditions. This allows you to identify weaknesses and adapt it to reduce the risk of losing money.

A well-designed automated trading system should include the risk management process which includes stop-loss order and size of the position. Additionally, it incorporates risk-to-reward and risk limits. Backtesting and optimization are all aspects of it. These features can limit the possibility of loss and improve the overall performance of the trading platform. Follow the top automated trading software for website info including kraken crypto exchange, automated option trading software, forex forum for beginners, bittrex fees, best crypto app for beginners, trade ez forum, algorithmic trading forum, shrimpy crypto, bitseven mobile app, automated cryptocurrency trading, and more.

[youtube]LnuBmAy80rY[/youtube]